The Central Bank of Paraguay (BCP) has revised its 2025 economic growth forecast upward, increasing it from 4.0% to 4.4%. This adjustment reflects the country’s economic performance, which has been stronger than expected during the first half of the year.

With this revision, the BCP affirms that Paraguay is on track to register an annual growth rate above 4% for the third consecutive year, a situation that has not occurred since the 2006-2008 period.

The President of the Republic, Santiago Peña, celebrated the new forecast on X.: “Good news for Paraguay. The BCP raised its economic growth forecast for 2025 to 4.4%, driven by the dynamism of services, livestock, and manufacturing. This translates into more jobs, investment, and opportunities for Paraguayans,” he posted.

The economic growth forecast

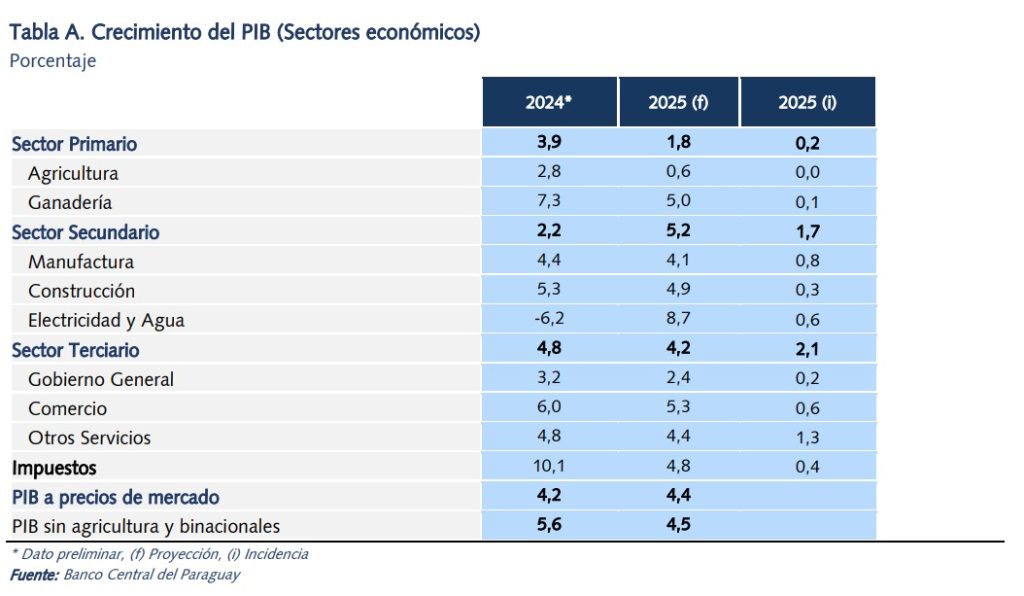

Economic activity expanded beyond expectations in the first five months of the year. The highest gross domestic product (GDP) growth is expected to be driven by the services sector, whose improvement is explained by the anticipated increase in trade activity (from 4.2% to 5.3%).

The primary sector was revised upward, largely due to livestock growth rising from 2.3% to 5.0%, supported by strong export volumes and values. For example, Paraguay’s beef exports surge to over US$1 Billion in remarkable first half of 2025. In the secondary sector, manufacturing improved slightly (from 3.9% to 4.1%), while electricity and water (8.7%) and construction (4.9%) maintained previous projections.

The tax growth forecast was revised from 3.7% to 4.8%, in line with higher product tax collection and stronger economic activity. As a result, GDP excluding agriculture and binational companies is now projected to grow by 4.5%, up from 4.0%.

The new inflation numbers

Inflation moderated in the second quarter, with average monthly inflation dropping from 0.9% to 0.1%. This decline was mainly due to falling prices in volatile components, especially fruits and vegetables, whose monthly inflation dropped from 9.8% to -4.9%. The year-on-year inflation also eased, falling from 4.2% to 3.8%.

However, the overall inflation forecast was revised upward due to rising prices in other food items, particularly meat. Despite this, there are no signs of external inflationary pressures. Assuming no new shocks, inflation is expected to end 2025 at 4.0%, gradually aligning with the 3.5% target over time.

Risk scenarios

The main risks to Paraguay’s economic activity and inflation remain external. Uncertainty over U.S. economic policy and concerns about its fiscal outlook are pushing up long-term interest rates and weakening the dollar globally. Meanwhile, rising geopolitical tensions in the Middle East add an additional risk.

The implementation of new trade barriers or retaliatory measures could slow global growth and disrupt supply chains, potentially driving inflation. While lower international demand may ease commodity prices, adverse weather or escalating conflicts could raise them or increase price volatility.

The full Monetary Policy Report for June can be found on the BCP’s official website.