Paraguay’s government has outlined an industrial strategy targeting economic doubling within ten years, a bold goal for a landlocked country frequently viewed as logistically constrained by investors. Vice-Minister of Industry Marco Riquelme and Francisco Martino, president of the Young Industrial Union, lead the initiative.

The plan targets growth from US$45 billion annually to US$90 billion within a decade, exceeding Paraguay’s historical 3.5 per cent yearly growth. It identifies 27 specific products across four priority sectors.

Strategic sectors: The core of Paraguay’s industrial strategy

Riquelme focuses the roadmap on four sectors: food processing, metalworking, forestry, and technology. The strategy emphasises value-added production over raw commodity exports.

The technology sector encompasses artificial intelligence, hydrogen energy, and digital infrastructure. Riquelme highlights Paraguay’s renewable energy advantage, hydroelectric power at lower costs than neighbouring countries.

Beyond borders: Paraguay’s communication challenge

Riquelme identifies limited international awareness as a critical challenge for the landlocked country. “The first step is telling the world that Paraguay exists,” he explains. The nation possesses industrial infrastructure, fiscal incentives, and macroeconomic stability, yet remains overshadowed by larger regional economies.

Paraguay offers competitive tax rates: lower value-added tax, reduced corporate income tax, and no transaction taxes. The 2025 Maquila Law strengthened these benefits. Riquelme emphasises that presidential diplomatic efforts and enhanced marketing are essential to building investor confidence.

Geographic advantage: The waterway

Riquelme notes that investors often incorrectly assume Paraguay’s landlocked geography creates logistical disadvantages. The Paraguay-Paraná Waterway serves as a major transport asset. This 3,400-kilometre corridor handles over 80%of Landlocked Paraguay’s international commerce.

Waterway transport costs substantially less than trucking. A single barge capacity approximates dozens of vehicles. Government officials contend this advantage remains underutilised in investor calculations.

Technology: Uneven but improving

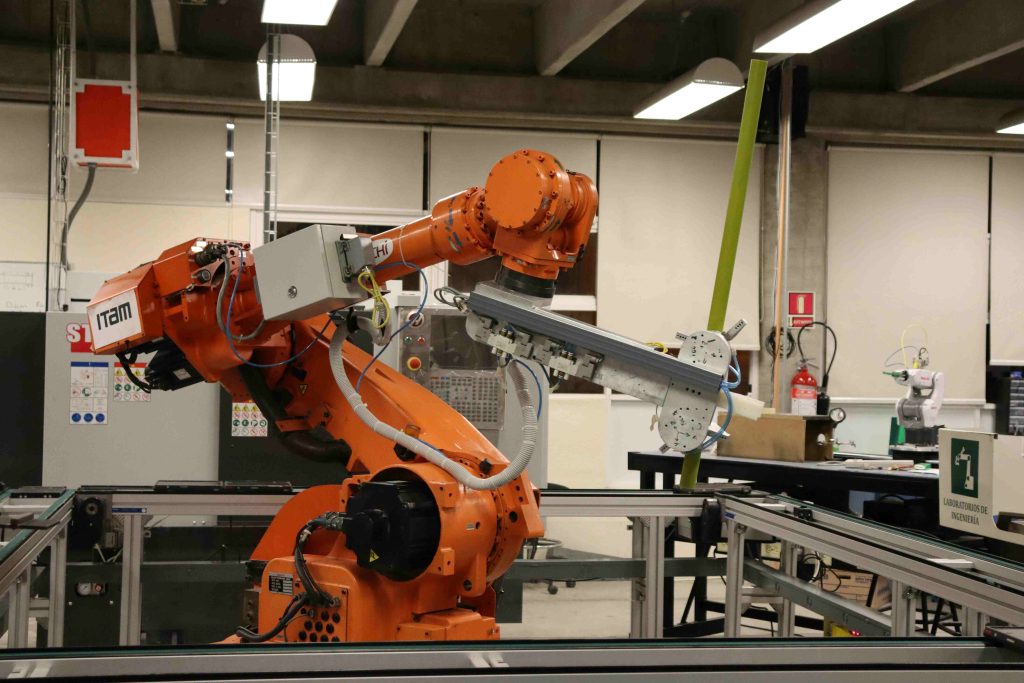

Paraguay’s technological adoption varies by sector. Diego Peyrat, executive secretary of the National Council of Maquila Export Industry (CNIME), reports that the maquila sector demonstrates significant automation and digital system implementation. Export processing procedures reduced from nearly one day to under one minute through intelligent systems.

However, advancement concentrates in larger enterprises. Smaller manufacturers lag considerably. Riquelme identifies market scale as the constraint: Paraguay’s domestic market cannot justify expensive machinery for local consumption. Foreign firms establishing operations introduce global standards and expertise, creating exposure for local suppliers.

Research shows factories integrating artificial intelligence, automation, and data analytics achieve 60 per cent productivity gains compared to conventional operations.

Human capital: The critical gap

Riquelme outlines three policy priorities: territorial planning reforms for manufacturing clusters, financial accessibility initiatives for long-term credit, and labour preparation.

Martino emphasises that incoming industries require technicians, engineers, and skilled operators. Current education systems produce graduates lacking adequate specialisation, forcing companies to conduct internal training. Worker retention poses a challenge: skilled workers relocate to Brazil or Argentina for higher wages.

Research confirms skills investment drives performance. Factories prioritising worker development report 16 per cent outperformance compared to conventional operations.

Sustainability: Environmental considerations

Environmental standards increasingly determine market access. Martino observes that large exporters with certifications command premium prices, but smaller enterprises cannot absorb sustainability investments without operational risk.

Sustainability benefits only certain industries. “Today sustainability is a market demand, but only some industries can monetise it,” Martino explains. Government strategy prioritises economic scale first. As enterprises expand, financial capacity for environmental improvements follows naturally.

Integration: Economic sectors

The industrial strategy integrates manufacturing with agriculture and service sectors. “We must do everything together,” Martino states. Agricultural sectors provide raw materials, manufacturing adds value through processing, and services support operations.

Value-added processing transforms economics dramatically. Raw soy exports generate hundreds of dollars per tonne. Soy-derived animal protein generates thousands per tonne. These differentials directly influence wage levels and reinvestment capacity.

Implementation: Variables and outcomes

Both leaders acknowledge Paraguay’s competitive advantages: renewable energy, strategic location, improving regulations, and infrastructure development. However, implementation depends on execution.

Success involves factors beyond government control: global demand, investment flows, and commodity prices. Government influences critical variables: infrastructure development, education alignment, regulatory consistency, and institutional stability.

Martino emphasises international market access as the catalyst. “Access to international markets gives us volume, brings technology, and opens space to innovate,” he states. Implementation outcomes over the following decade will demonstrate strategy viability.