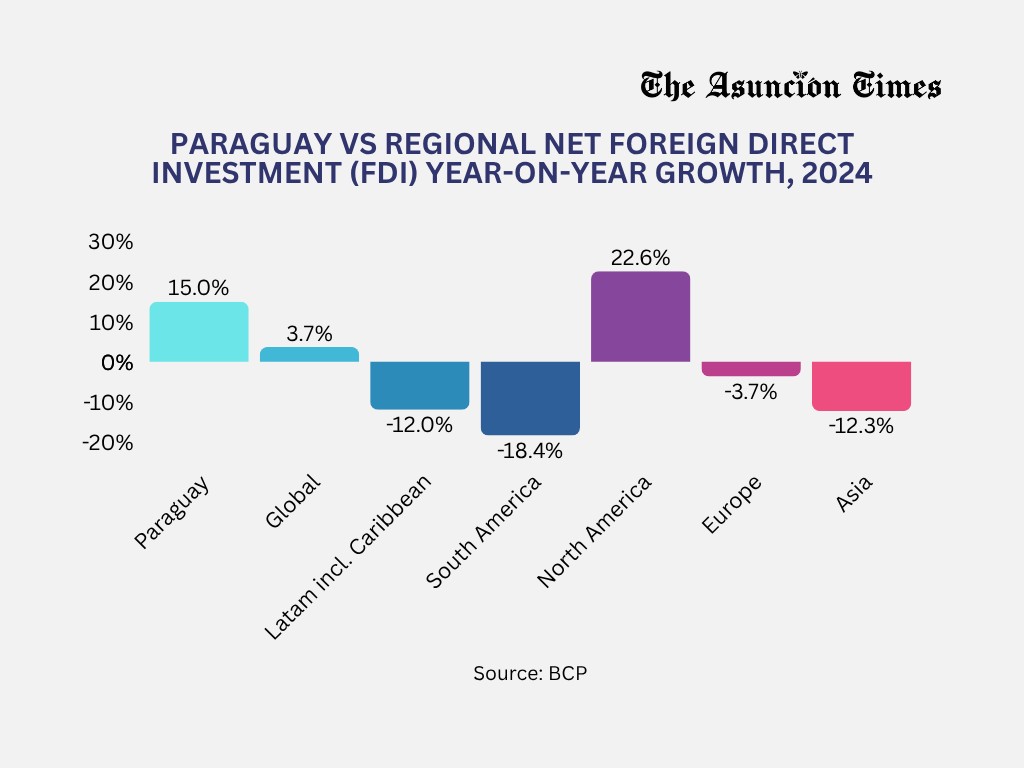

The Central Bank of Paraguay (BCP) released its latest report on Foreign Direct Investment (FDI) for 2024, revealing positive numbers for the country. While Latin America and the Caribbean saw an average decline of 12% in FDI, Paraguay stood out with strong and steady growth.

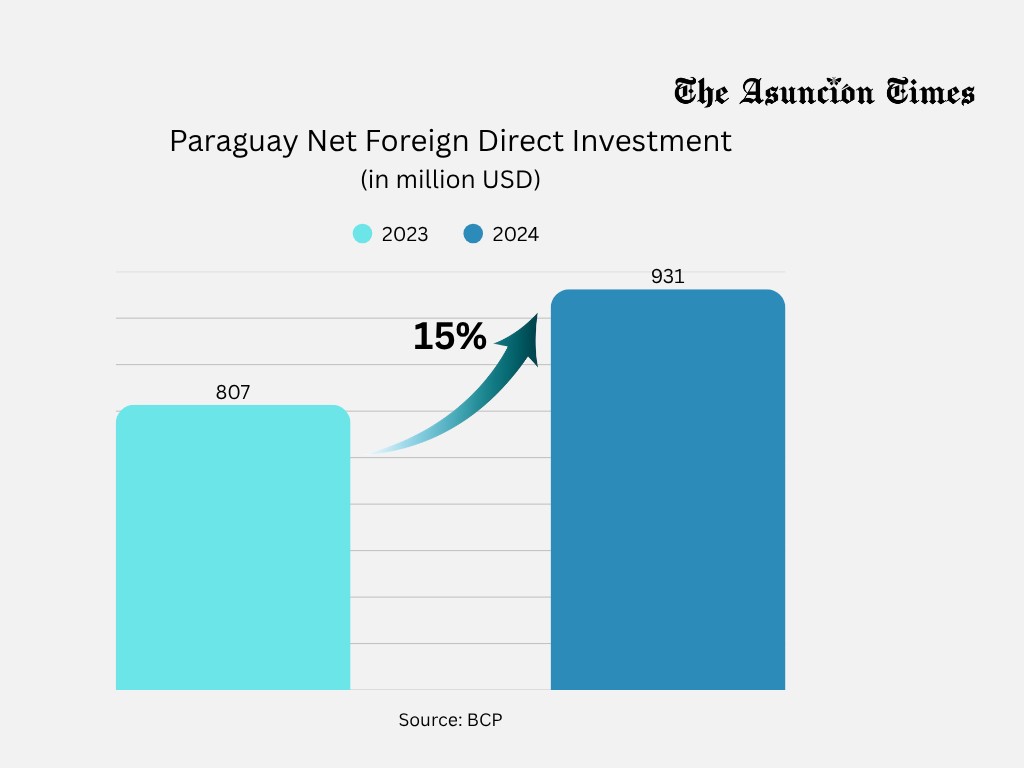

In Paraguay, net foreign direct investment (FDI) reached US$931 million in 2024, marking a 15% increase compared to the previous year. This balance resulted from gross inflows of US$3.291 billion and gross outflows of US$2.360 billion. As a result, the total direct investment balance at the end of 2024 stood at US$10.395 billion, representing a 3.8% increase over 2023.

The report highlights that this increase was mainly driven by capitalisation and reinvestment of profits. These positive flows were partially offset by negative net loans, derived from the placement of assets and the amortisation of foreign liabilities.

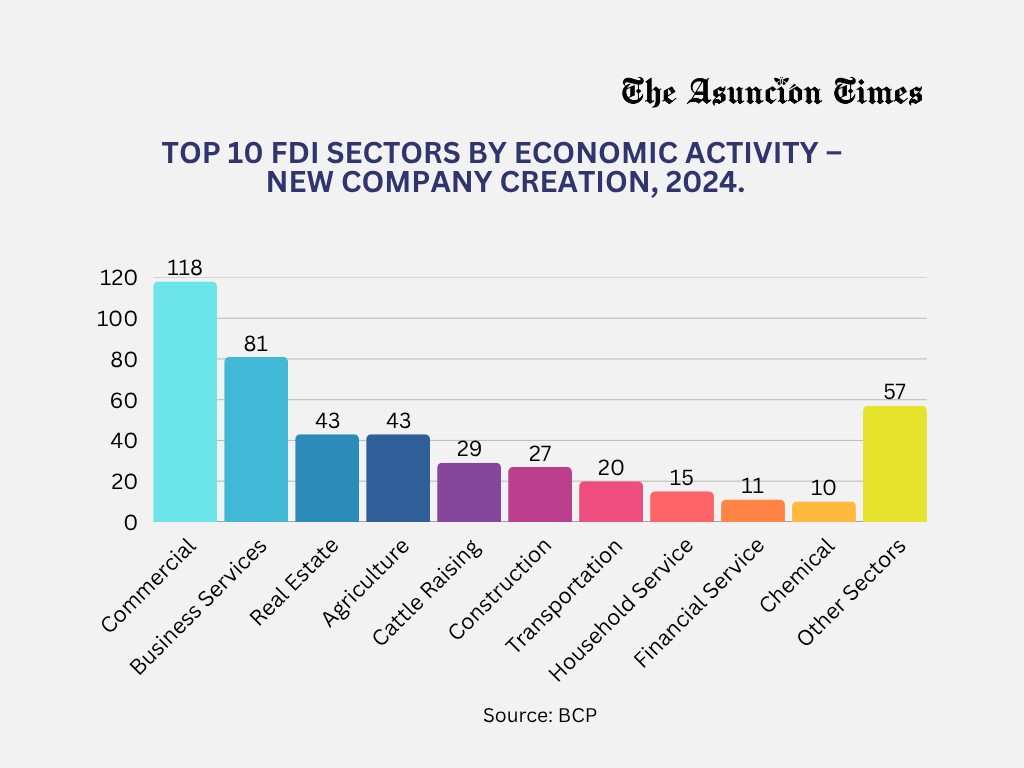

Most dynamic sectors in Paraguay

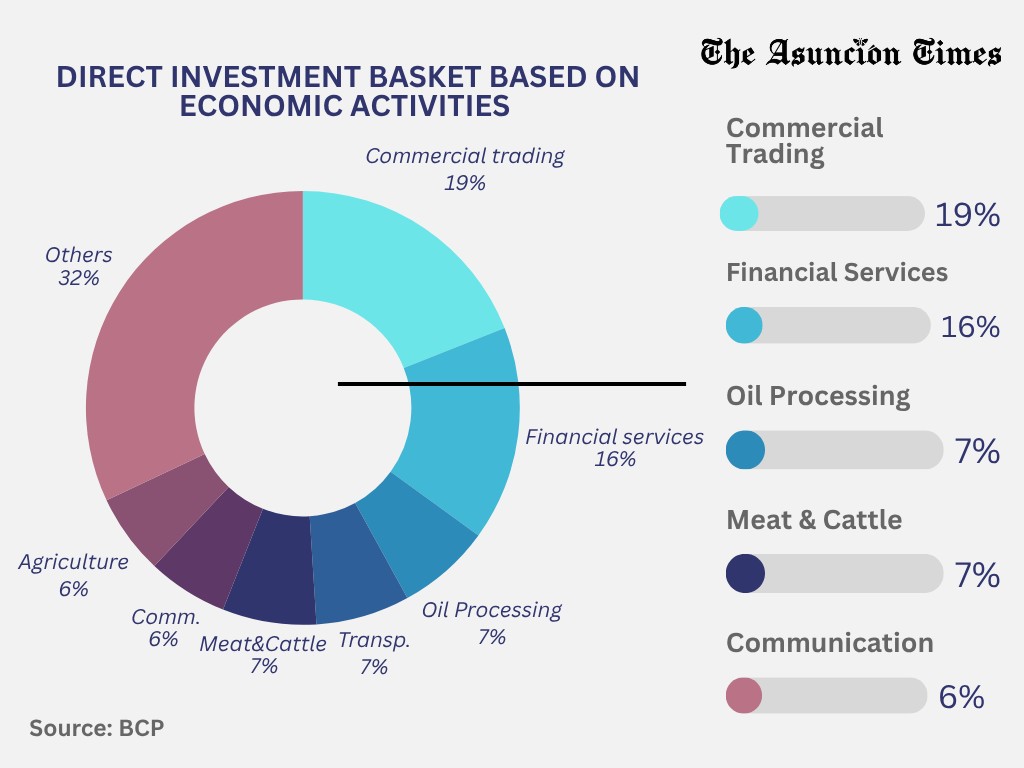

During 2024, the most dynamic sectors in terms of foreign direct investment were trade, business services, communications, meat production, and financial intermediation, according to data from the BCP. The net flow by sector was as follows:

- Trade: US$219 million

- Business services: US$177 million

- Communications: US$109 million

- Meat production: US$108 million

- Financial intermediation: US$73 million

In contrast, some sectors recorded negative net flows, particularly metal products (-US$31 million), real estate services (-US$6 million), other food production (-US$5 million), oil processing (-US$4 million), mining (-US$4 million), dairy production (-US$0.8 million), and sugar production (-US$0.2 million).

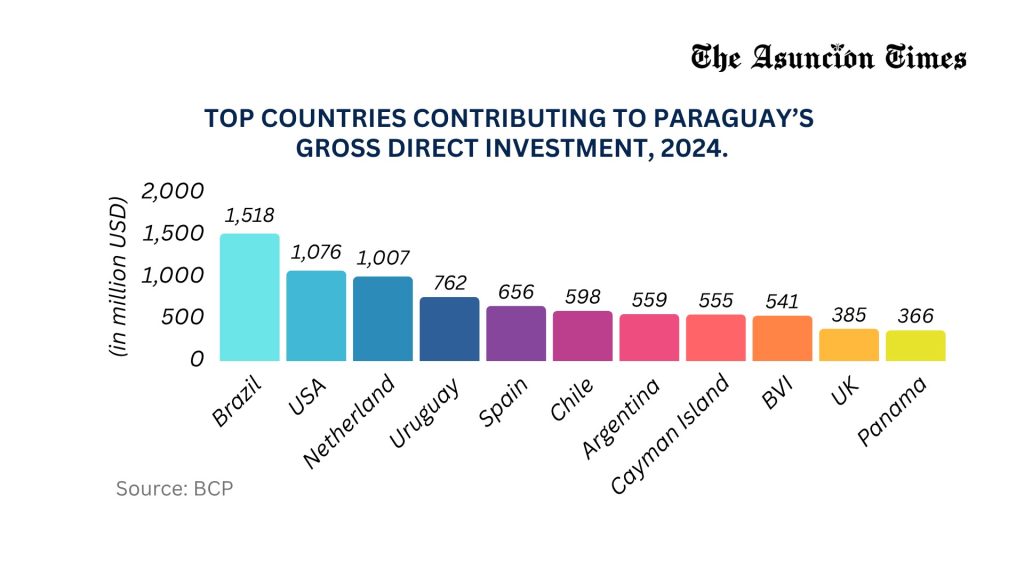

Countries leading in foreign direct investment in Paraguay

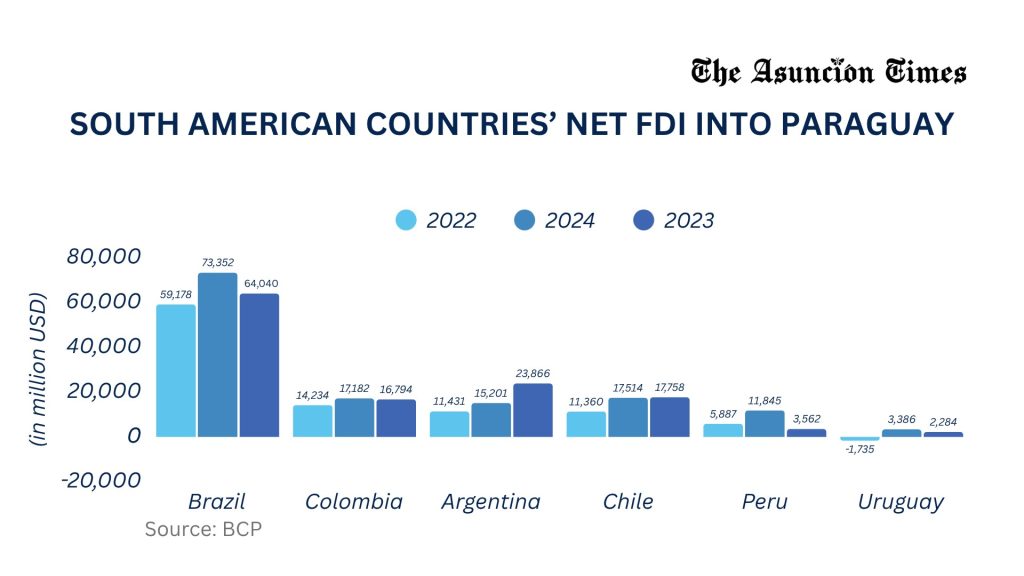

In recent years, Paraguay has received FDI from an increasing number of countries. Brazil remains the main source of investment, contributing US$1.568 billion (15% of the total). This is followed by the United States with US$1.076 billion (10%), the Netherlands with US$1.007 billion (10%). Uruguay follows with US$762 million (7%), and Spain with US$656 million (6%).

The report highlights the growing participation of countries such as Chile (US$598 million) and Argentina (US$559 million). British Territories such as the Cayman Islands (US$555 million), and the British Virgin Islands (US$541 million) are also participating more. All expanded their presence in the Paraguayan market over the past year.

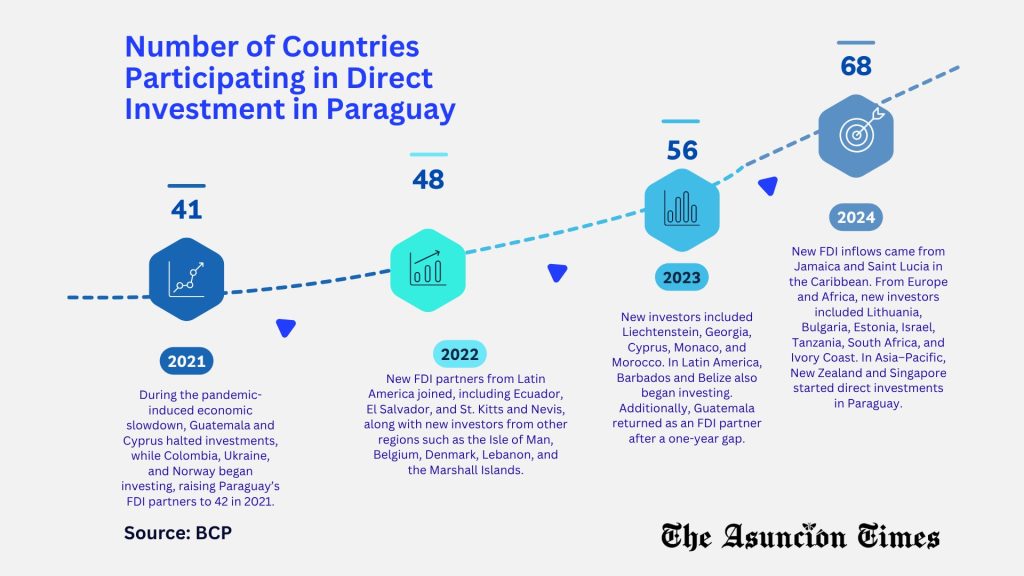

The number of countries investing directly in Paraguay increased from 39 in 2008 to 68 in 2024. As foreign direct investment has become a key source of external financing, its share within Paraguay’s International Investment Position liabilities has grown significantly from 14% in 2008 to 28% in 2024.

The region’s performance

At the regional level, Latin America and the Caribbean experienced a 12% decline in FDI, reaching US$164 billion. South America recorded an 18% reduction in net FDI flows, affected by lower inflows to the region’s largest economies.

Brazil registered a fall of 8%, Colombia 14%, Argentina 52%, Chile 36%, Ecuador 51%, and Uruguay 176%. In contrast to this downward trend, only Paraguay (15%), Peru (65%), and Bolivia (3%) recorded growth in their net foreign direct investment flows.

Important considerations

The BCP notes that, as the compilation of FDI statistics is an ongoing process, each publication includes new and more comprehensive information. Consequently, the figures presented in this edition are considered preliminary and may be subject to revision in future reports. The full report is available on the BCP’s website.

Read more: Paraguay Congress Approves New Investment Laws: What Is The Impact?