For the second consecutive year, Paraguay’s tax system has been recognised as the most competitive and neutral in Latin America. Paraguay is placed ahead of its neighbours in terms of competitiveness, efficiency, and neutrality. This highlightes the country’s growing appeal to international investors.

Paraguay’s results are shown by the Comprehensive Tax Index, published by the Adam Smith Center at Florida International University. The index evaluates how the region’s tax systems promote investment while minimising economic distortions. Applications of corporate, individual, excise, property, real estate, and international taxes are measured and scored.

Fundamental criteria

The study assesses tax systems in Latin America on the basis of two fundamental criteria: competitiveness and neutrality.

Competitiveness refers to how favourable a country’s tax structure is to encouraging economic growth, savings, and investment, without placing undue burdens on individuals or businesses.

Neutrality, on the other hand, measures the extent to which the tax system avoids distorting economic decision-making, allowing market forces to operate freely. This comprehensive analysis provides a clear picture of how each nation’s tax framework supports or hinders economic development.

Paraguay’s tax system leading

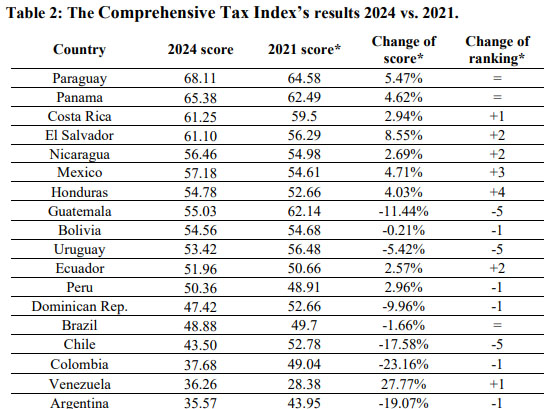

The Comprehensive Tax Index assessed eighteen countries across Latin America, with only four surpassing 60 points on the Adam Smith Center’s scale: Paraguay, Panama, Costa Rica, and El Salvador. Leading the list, Paraguay achieved a score of 68.11 points, reflecting a 5.47% increase compared to 2021.

Paraguay’s top performance is largely attributed to its approach to corporate income tax, where it maintains the lowest rate in Latin America. It also scores highly in consumption taxes, with a value-added tax (VAT) that is considered one of the most neutral in the region, free from exemption thresholds and excessive complexities.

The report highlights that Paraguay imposes no restrictions or special rules on foreign-controlled companies, offering a level playing field for both domestic and international investors.

Destination for productive investment

This recognition not only strengthens Paraguay’s reputation as a reliable destination for productive investment. It also reflects its broader commitment to economic development and fair taxation practices.

Read more: Last year Paraguay’s tax revenues for the month of November closed with a balance of US$78 million more than the same month a year prior.